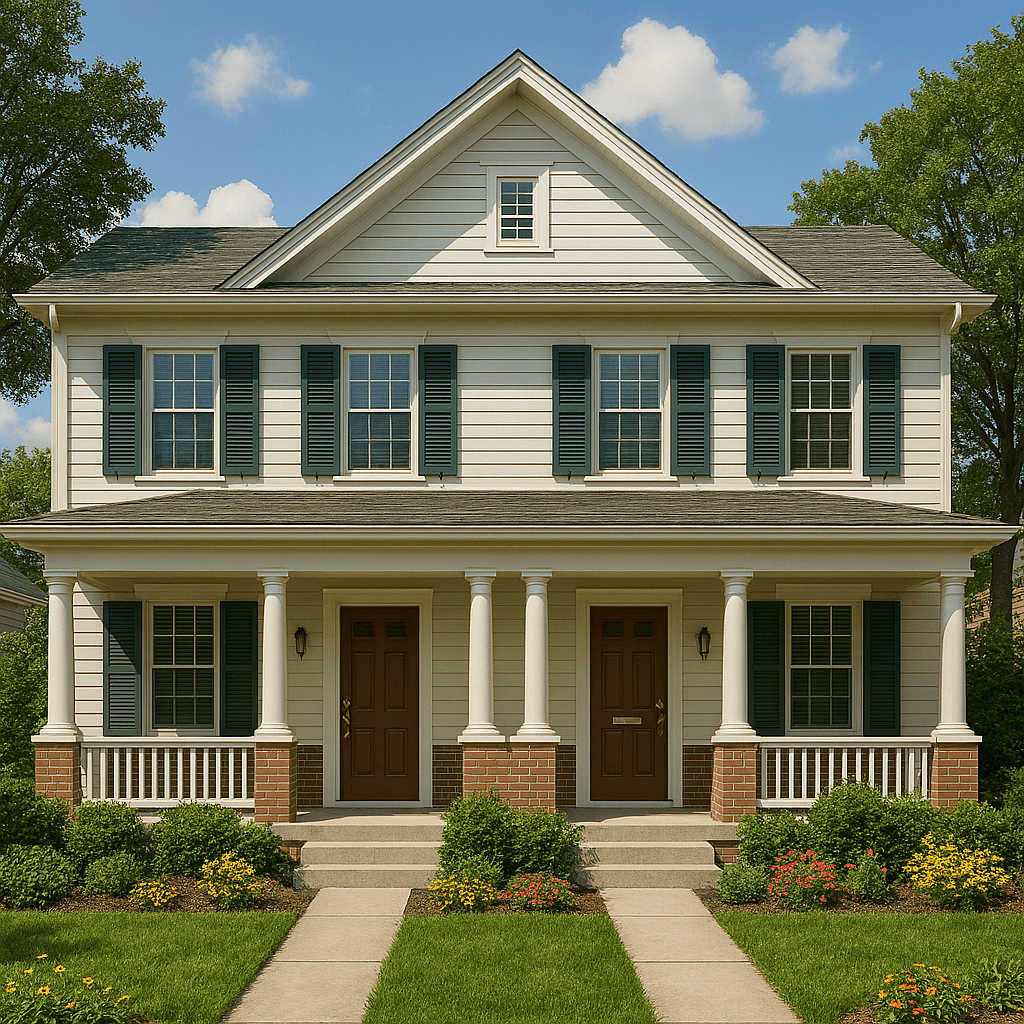

Jointly purchasing a home, duplex, or multi-family property is a significant financial and personal decision. Here are some helpful tips and recommendations, along with things to be mindful of, for people buying a home together that are not married and/or not intending to live in the same home/unit as one another.

Before You Start Looking

1. Define Your Goals and Non-Negotiables:

- Lifestyle: What kind of neighborhood do you want? How important are schools, proximity to work, or outdoor spaces?

- Property Type: Are you set on a single-family home, or a duplex, or is a 3–4-unit property an option? For a duplex, will you live in one unit and rent out the other, or will you each reside in your own respective unit?

- Must-Haves vs. Nice-to-Haves: Create a list of essential features (e.g., number of bedrooms, a yard) and things you'd like but can live without (e.g., cosmetic things like a specific type of kitchen countertop).

2. Have Open and Honest Financial Conversations:

- Credit Scores: Share your credit scores with each other. A lower score can affect the interest rate on your mortgage.

- Income and Debts: Be transparent about your income, existing debts (student loans, car payments, credit card debt), and other financial obligations.

- Down Payment: Discuss how you will contribute to the down payment. Will it be a 50/50 split, or will one person contribute more? Document this in a written agreement.

- Ongoing Costs: Talk about how you will handle monthly mortgage payments, property taxes, insurance, and utilities.

3. Consider seeking Legal and Financial Counsel:

- Real Estate Attorney: It is highly recommended to hire a real estate attorney. They can help you draft a co-ownership agreement that outlines what happens in various scenarios. This could be beneficial even when buying with family. While it isn’t required, it is an added layer of protection.

- Financial Advisor: A financial advisor can help you understand the long-term financial implications of the purchase and how it fits into your overall financial plan. Especially if you are withdrawing funds from current brokerage and retirement accounts to use toward your home purchase.

Legal and Ownership Considerations

4. Choose the Right Form of Ownership:

- Joint Tenancy with Right of Survivorship: If one owner dies, their share automatically transfers to the surviving owner. This is common for married couples or partners who want to ensure the property stays with the survivor.

- Tenancy in Common: Each owner has a distinct, undivided share of the property. If one owner dies, their share goes to their heirs (as designated in their will) rather than the co-owner. This is a common choice for business partners or friends, as it allows for unequal ownership shares (e.g., one person owns 60%, the other 40%).

- Community Property (in some states, like CA): For married couples in certain states, assets acquired during the marriage are considered community property and are owned equally.

5. Create a Co-Ownership Agreement:

- The "What If" Document: This is one of the most crucial documents you will create. It should be drafted with the help of a lawyer for the most protection, and cover the following:

- Contributions: Clearly state who contributed what to the down payment, closing costs, and renovations.

- Monthly Expenses: Detail who is responsible for which monthly expenses (mortgage, taxes, insurance, maintenance).

- Selling the Property: What if one person wants to sell and the other doesn't? Outline a process for a buyout or a mandatory sale.

- Disputes: How will you handle disagreements? Mediation or arbitration clauses can be included.

- Termination: What happens if the relationship ends? A buyout clause can specify how one person can buy out the other's share, including the valuation method (e.g., an independent appraisal).

- Death or Disability: What happens to the property if one owner becomes disabled or passes away?

During the Home Buying Process

6. Get Pre-Approved for a Mortgage:

- Joint Application: The credit, income and assets of all borrowers are considered in the risk assessment for loan approval and the rate and terms available.

- Don’t Get Stuck on Rate: While there is natural desire to have the best rate and terms available, there is often truth in the saying, “you get what you pay for”. Shopping around can be beneficial, but not just in rate and terms. You can benefit from working with a Mortgage Broker, who is generally your professional rate and options shopper, but it’s also the education, empowerment, advocacy and structure overall that has a big impact on the ultimate loan you choose and overall benefit you will receive. The lower rate is immaterial if you cannot cross the finish line with the lender offering it. Knowing the difference for the impact of the lender you choose on your offer acceptance likelihood, how well they advocate on your behalf, and whether you receive an education around your various options and strategy, can save you thousands of dollars beyond just your interest rate.

- Monitoring your credit habits to optimize your scores: In preparation for a home loan, it will be important to be mindful of your balance to limit usage (credit utilization) and maintain a perfect payment history. The sweet spot for your balance to limit on revolving credit is 1-9%. Showing some monthly balance while maintaining low leverage and perfect payment history shows restraint and responsibility that optimizes your credit score. Credit is a borrow pay history so maintaining zero balances is not as helpful over time. You’ll also want to keep at least 2 credit accounts active in use and reporting to the credit bureaus. See my additional credit tips for more information.

7. Be Realistic About Your Budget:

- PITI: Remember that your monthly payment includes more than just the principal and interest. It also includes property taxes and homeowners’ insurance (PITI).

- Added Costs: Factor in other costs like a home inspection, appraisal, closing costs and potential repairs after you move in.

- Other Post-Closing Ownership Costs and Considerations: The need for unexpected repairs can arise. Consider having a house account that everyone contributes to for the management of paying the mortgage, taxes, insurance, and unexpected urgent repair expenses. Discuss now who will manage the payment of these expenses from the joint account and what verification should be readily available and in what platform for the other owners to show it is managed as expected. All owners having access to the account to see outgoing expenses related to the home could be easiest with the fixed expenses on auto pay. However, be mindful of whether there is any potential variability in the expense. For example, a fixed loan with just principal and interest will stay exactly the same during the fixed period. However, adding in the collection of property taxes and insurance to a mortgage payment with escrow impounds, causes a variability that can change the payment amount.

For Duplex and 3–4-unit Buyers

8. Understand the Landlord Responsibilities:

- Screening Tenants: Be prepared to run background and credit checks, verify income, and interview potential tenants.

- Maintenance and Repairs: You will be responsible for maintenance for the entire building, not just your unit. This can include plumbing, roofing, and common areas.

- Legal Compliance: Be aware of local and state landlord-tenant laws, including fair housing laws, security deposit regulations, and eviction processes.

- Separate Finances: It's wise to open a separate bank account for the duplex to manage rent payments, maintenance costs, and other landlord expenses.

- Consider Hiring a Property Manager: If you are looking to add rental property to your home purchase goals and don’t want to manage it on your own, using a property manager can be effective in reducing the stress of managing property. Albeit that will come at a cost, so it’ll be important to explore how that impacts the cash flow and your overall goals and needs.

9. Consider Rental Income:

- Mortgage Qualification: Generally speaking, 75% of the market rent or actual rent (whichever is less) is often eligible as additional qualifying income toward your loan eligibility. This can help you to qualify for a larger mortgage and thus purchase price. Granted, rental property, even when owner occupying one of the units, does also require a larger down payment.

- Potential Vacancy: Don't assume the rental unit will always be occupied. Plan for periods of vacancy and have a financial buffer to cover the full mortgage payment.

By being open, transparent, and proactive in addressing these points, you can significantly reduce stress and potential conflicts, ensuring a smoother and more successful co-ownership experience.

If you happen to be buying property in AZ, CA, CO, FL or TX I’d love to help! Contact me today with any questions and to get started on your home financing preparation.